From Belgium to Bangkok: How a Couple Secured Double-Digit Returns in Bearing

When an Expat couple living in Belgium approached me to inquiry about Bangkok's investment I immediately recognized a good pattern: they were already investors in Belgium and they were ready to diversify their investments into a new country. Guided with multiple videocalls, they turned to Bangkok’s eastern corridor, choosing Bearing, a Bangkok neighborhood strategically positioned between Bangkok’s new mega-projects and the fast-growing Sukhumvit line.

Why BTS Bearing?

Bearing is just 1.3 km from the BTS station, with shuttle buses and ride-hailing apps making access seamless. The area is rapidly transforming thanks to new landmarks: The Bangkok Mall, Cloud 11, and True Digital Park, all of which anchor an ecosystem of international tenants, startups, and retail opportunities. For investors, this means strong rental demand and appreciation potential.

The Investment

The couple secured a 1-bedroom apartment for 2.3 million THB (≈ 61.000 EUR at that exchange rate), with an important discount offered by the developer to Zero Two Ventures clients. The complex has a swimming pool, Jacuzzi, Gym, Coworking and security services.

With the guidance of Zero Two Ventures, the unit was fully furnished with a simple yet effective IKEA setup, a strategy designed to keep costs low while appealing to Airbnb tenants.

Market Entry and Results

The property was listed on Airbnb on August 18 with a minimum booking of 1 month, as for the Thai Condo Law.

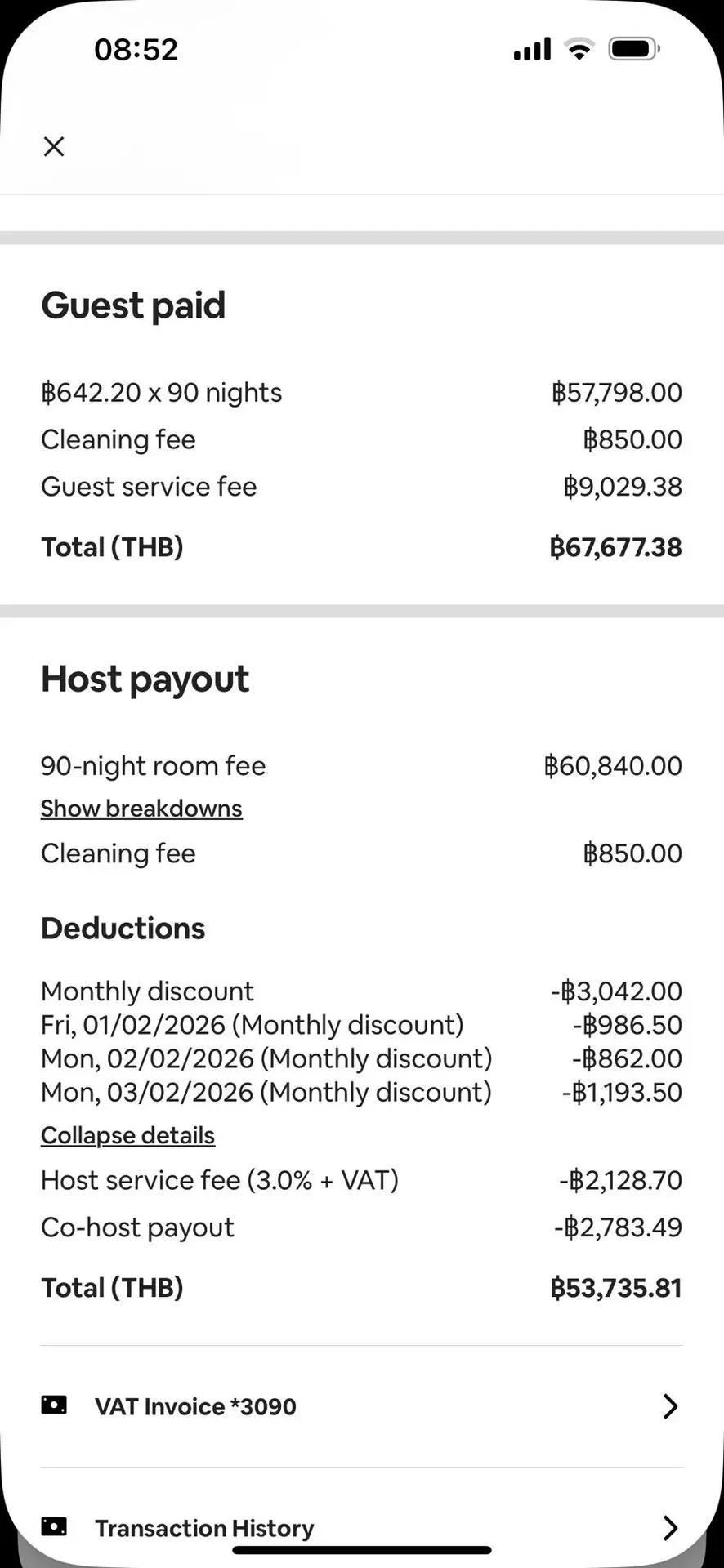

Within two hours, the first booking was secured. By September 4, the calendar was fully booked with 3 different bookings until April 2026.

Rental strategy was phased:

- Introductory rate: 15,000 THB/month to build reviews.

- Standard rate from 2026 onward: 22,000 THB/month.

This “ramp-up” approach is common in short-term rentals and accelerates credibility on platforms like Airbnb.

ROI Calculation

- Acquisition price: 2.3M THB (≈61,000 EUR).

- Furniture: 167.000 THB - 4.487 euro

- Average stabilized rental income: 22,000 THB/month (or 590 euro) (264,000 THB/year).

- Gross Yield: 264,000 ÷ 2,467,000 = 10.7% per year.

- Net ROI estimate: 8% per year

- IRR Estimate: 14%

Even factoring in early discounts (15,000–20,000 THB in the first months), the trajectory is clear: this property is locked into double-digit annual returns with appreciation potential as Bearing matures.

This case shows how timing, location, and execution can turn a modest investment into a high-performing asset. By leveraging Zero Two Ventures’ furnishing and market strategy, the couple not only secured bookings instantly but also locked in years of predictable income, proof that Bangkok’s emerging districts offer opportunities well beyond Sukhumvit’s core.