Research and Data

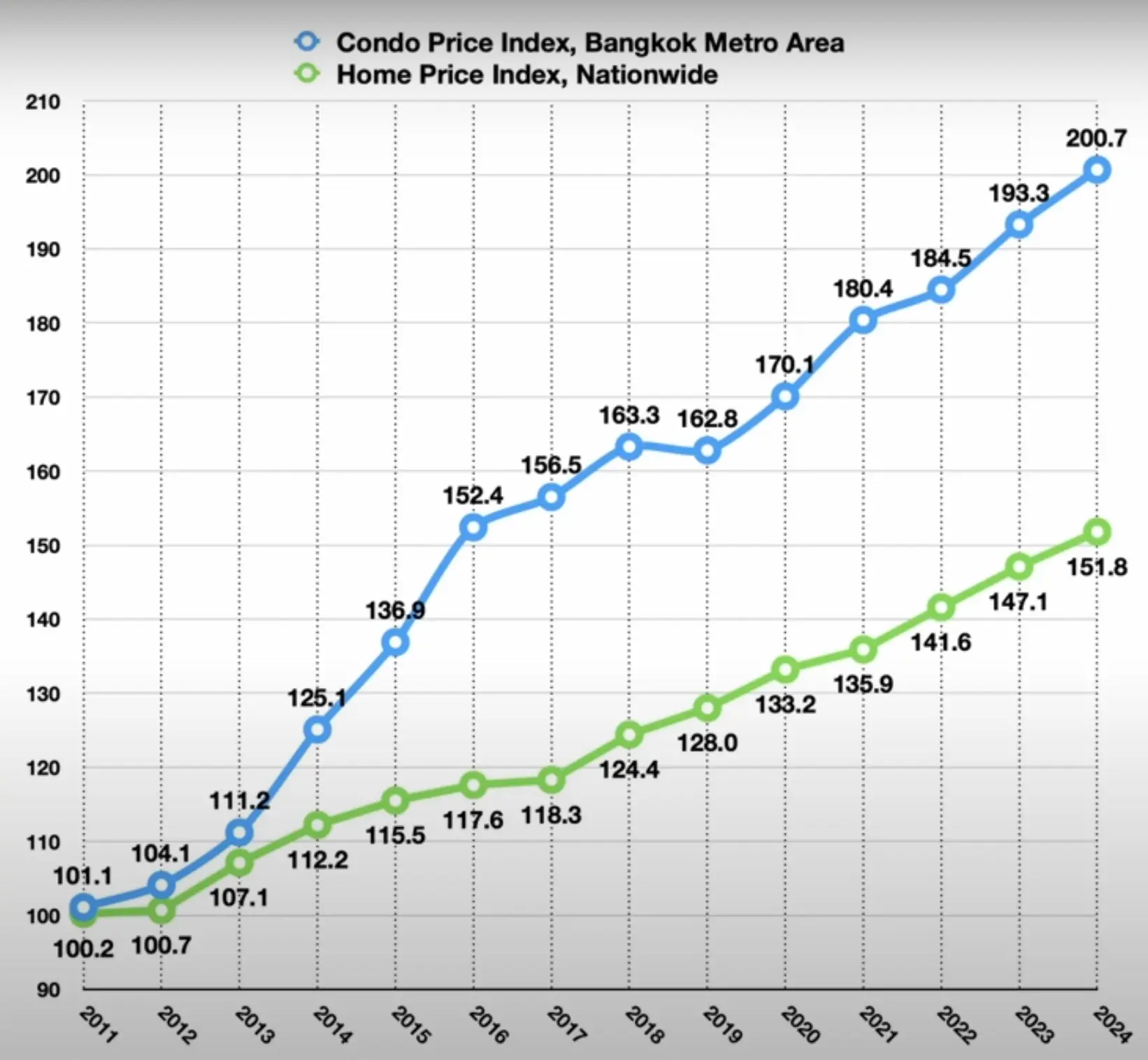

Bangkok’s Condo Prices. 2025-2011

The report explores key insights into Bangkok's condominium prices from 2011 to 2025.

Condominium prices in Bangkok more than doubled between 2011 and 2024, rising from an Index of 100.7 to 200.7, with an average annual growth of 5.45%. The sharpest increases occurred between 2013 and 2016, followed by a plateau and renewed growth after 2020.

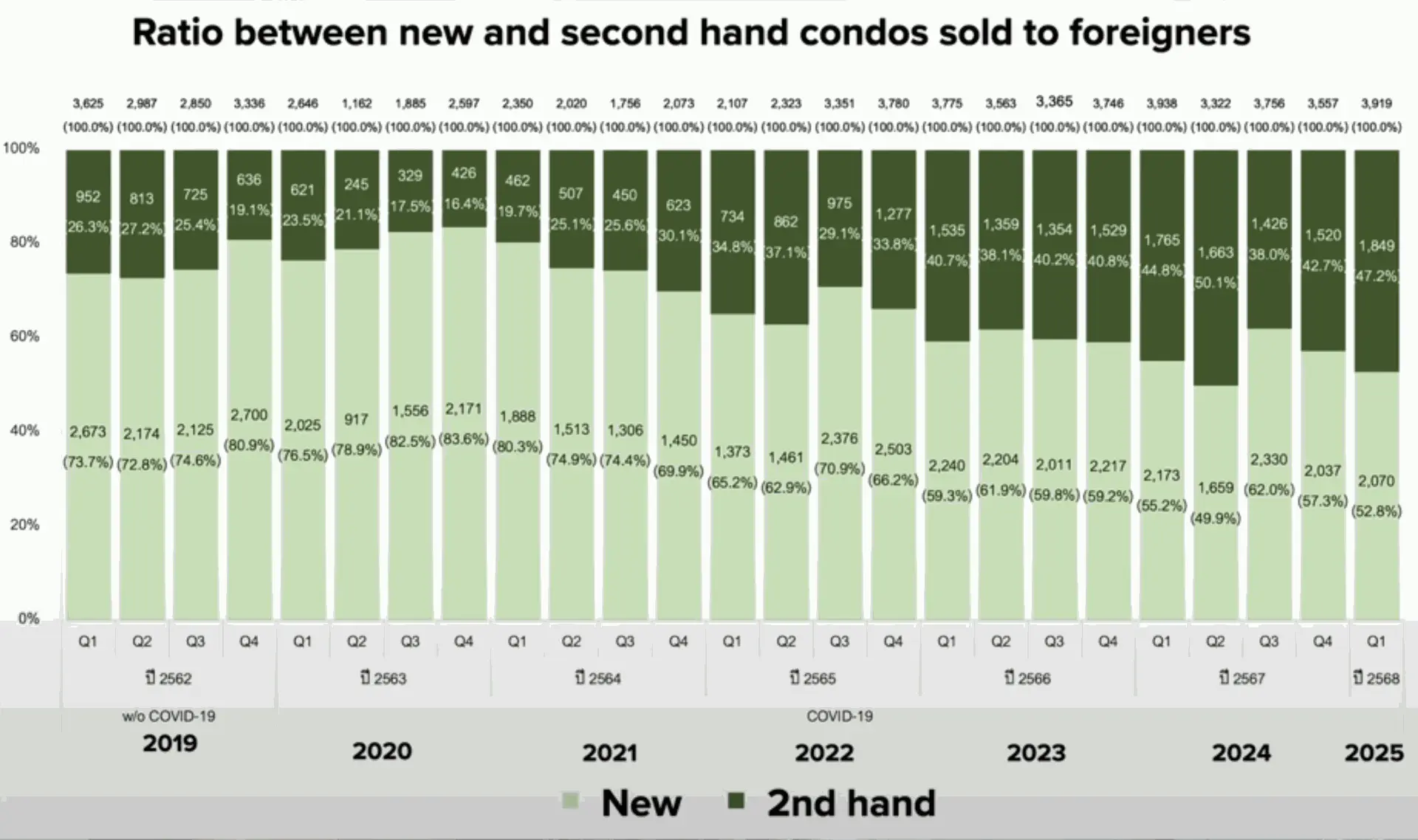

Foreign Ownership of Condominium units - Bangkok 2025 and second hand/new market

Foreign demand for Thai condominiums has not only recovered but surpassed pre-COVID levels. Sales rose from 12,796 units in 2019 to 14,044 in 2023 and 14,381 in 2024, setting a new record. The momentum carried into 2025, with Q1 sales hitting 3,919 units; if this pace continues, the year could close with 15,676 units sold to foreigners, the strongest on record.

Buyer preferences also shifted: in 2024, half of all foreign purchases were second-hand condos, but this share fell in 2025, as developer discounts boosted new-unit sales.

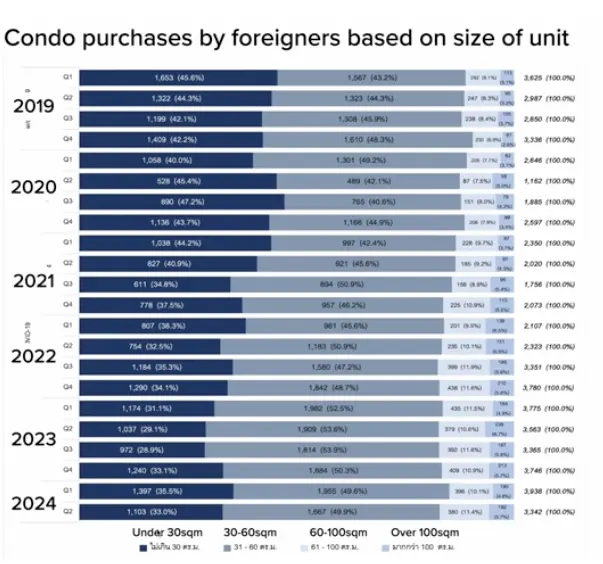

Foreign Ownership of Condominium units - Bangkok (September 2024)

The report explores key insights into Thailand's condominium market for foreign buyers from 2019 to 2024. In 2023, 14,044 units were sold to foreigners, marking a 9.7% increase over 2019. The total transaction value surged to 73.2 billion baht, compared to 50.6 billion baht in 2019.

Notably, 50% of foreign purchases in 2024 involved second-hand properties, highlighting a shift in buyer preferences. For a comprehensive analysis of pricing trends, nationalities of buyers, and market dynamics, download the full report.

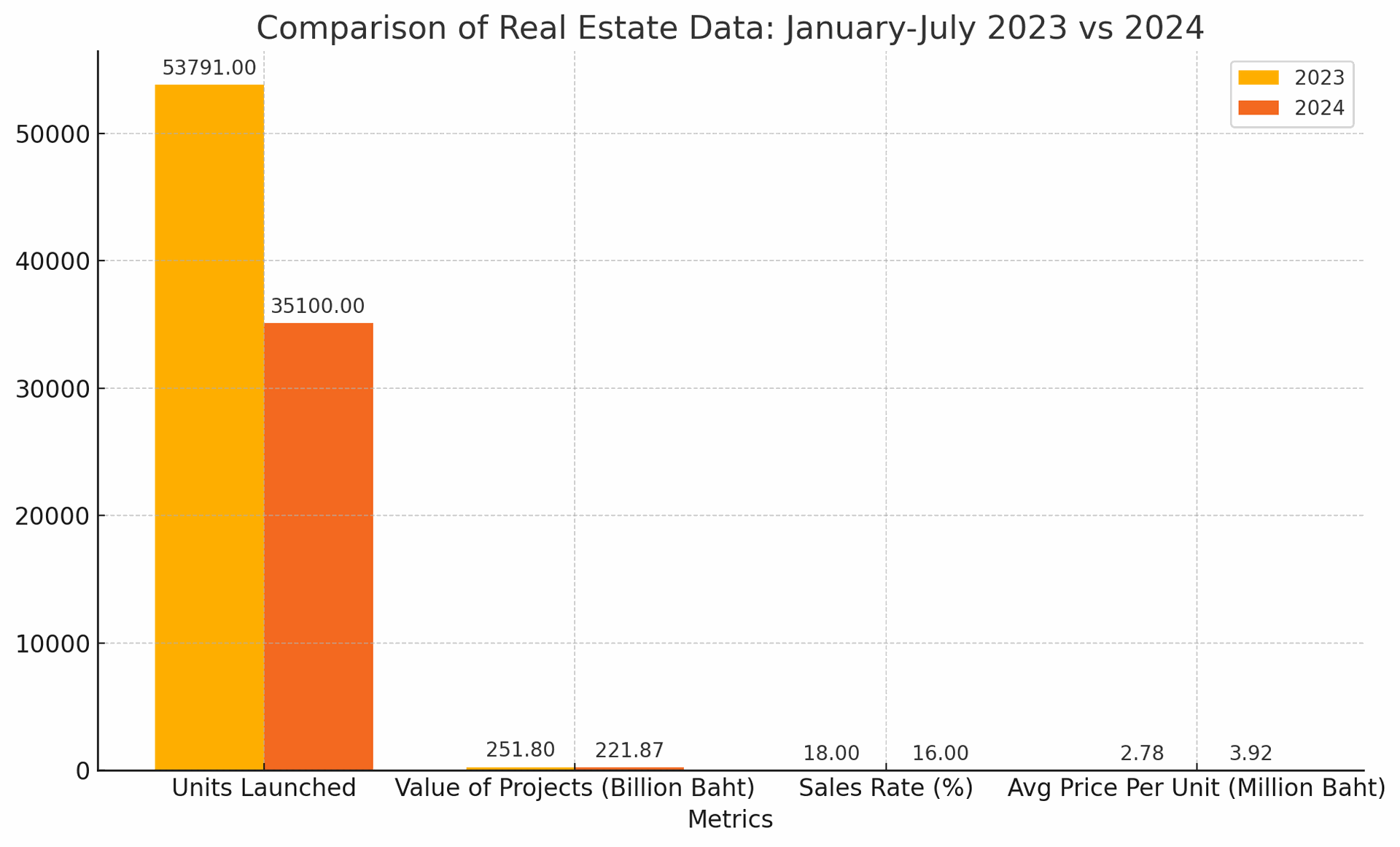

Supply of new condos - Bangkok (2022-2024)

From January to July 2024, 204 new projects were launched in Bangkok, totaling 35,100 units with a value of 221.865 billion baht, marking a 35% decrease in units and a 12% decrease in value compared to 2023. In the condominium sector, 13,868 units were launched, down 49% from 2023, while the average price per unit rose by 41% to 3.92 million baht.

For properties under 10 million baht, there was a 26% decrease in units, while luxury projects over 10 million baht saw a 20% increase in units launched. The market’s absorption rate remains stable, despite economic challenges including high interest rates and tighter financial conditions.

For detailed insights and data, download the full report