Bangkok, January 2026 -

When investors look at Bangkok condominiums, two-bedroom units are often overlooked in favor of smaller, faster-entry products. In reality, 2 bedrooms apartments can be extremely interesting for investors who are looking for higher liquidity.

This case focuses on an investment in Bearing, at Supalai City Resort Sukhumvit 107, built around one core thesis: true scarcity creates resilience.

Why Bearing, Once Again?

Bearing continues to benefit from its position along the Sukhumvit line, with direct access via BTS Bearing and proximity to Bangkok’s eastern innovation corridor.

With major developments such as Bangkok Mall, Cloud 11, and True Digital Park, the area attracts a diverse tenant base — from professionals to families — seeking more space without moving far from the city.

The Investment: A Quantifiably Rare Two-Bedroom

The unit is a two-bedroom condominium, a layout that has become exceptionally rare in Bangkok’s new supply.

In this specific building, only 28 two-bedroom units were released for sale in total, and this property was one of the last two available at the time of purchase.

That detail matters. Scarcity here is not conceptual — it is numerical.

The acquisition price was 4.6 million THB, equivalent to approximately 121,000 EUR at the exchange rate at the time of purchase.

Two-bedroom units offer structural flexibility:

- suitable for families relocating to Bangkok

- ideal for digital nomads sharing space or working remotely

- appealing to long-stay expats prioritizing livability

This makes them inherently more defensive across market cycles.

Furnishing & Interior Design

The property was furnished and optimized with a 450,000 THB budget, focused on functionality, storage, and long-term durability rather than short-term aesthetics.

This approach supports longer stays and reduces tenant turnover.

Market Entry and Immediate Demand

The unit was listed at 35,000 THB per month.

The market response confirmed the scarcity thesis:

- Rented within a few hours of listing

- Secured a 5-month booking immediately, minimizing vacancy risk

This level of absorption speed is uncommon and highlights the unmet demand for larger units in well-connected suburban districts.

Rental Outlook and Appreciation

- Current rent: 35,000 THB/month → 420,000 THB/year

- Annual rent appreciation: 5.5%

- Annual price appreciation: 5.5%

The dual growth of income and asset value creates a compounding effect that is particularly powerful in segments with structurally limited supply.

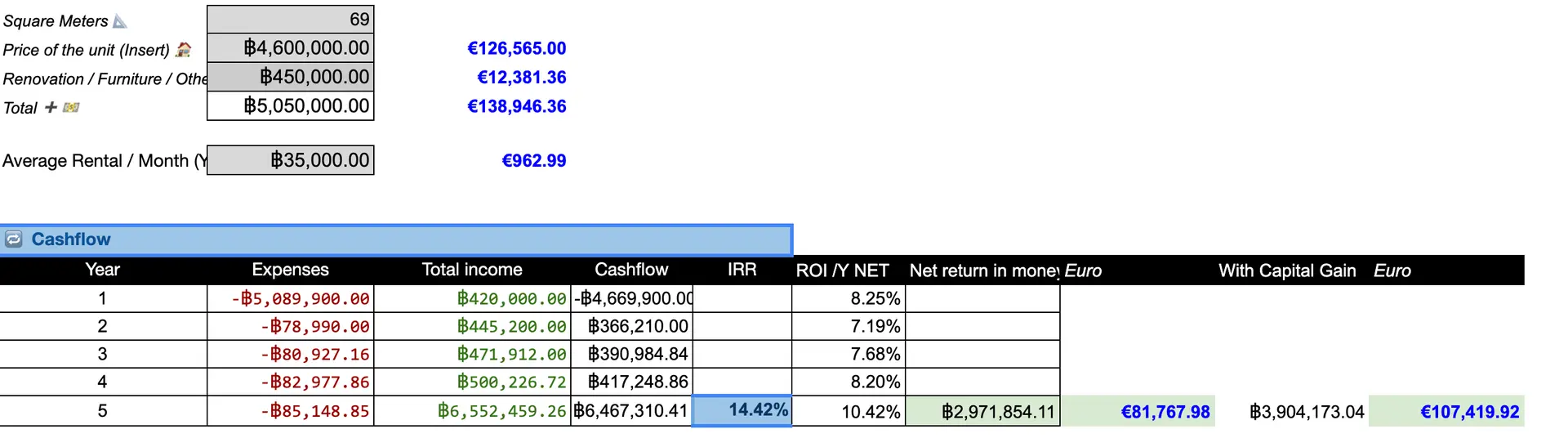

ROI Snapshot

- Purchase price: 4,600,000 THB (≈ 121,000 EUR)

- Furniture & interior design: 450,000 THB

- Total investment: 5,050,000 THB

- Annual rental income: 420,000 THB

Gross Yield (year one):

420,000 ÷ 5,050,000 = ≈ 8.3%

With 5.5% annual rent growth, cash flow strengthens each year, while capital appreciation enhances long-term IRR.

Why This Matters

Bangkok’s condominium market is increasingly dominated by small units. Larger layouts — especially two-bedroom units near mass transit — are no longer being produced at scale.

When supply is capped at 28 units in an entire building, and demand spans families, professionals, and remote workers, pricing power shifts decisively toward owners.

Final Takeaway

This investment illustrates a key principle: not all square meters are equal.

By acquiring one of the last two two-bedroom units available in a supply-constrained building, the investor secured immediate income, long-term defensibility, and a structurally scarce asset. In Bangkok, rarity is no longer a future thesis — it is already embedded in today’s best-performing investments.

The Condo is currently offered on Airbnb and it has been rented for 4 months within a few hours from its publishing.