Bangkok - January 2026

When foreign investors look at Bangkok, the first instinct is often to focus on entry-level units. In this case, however, the strategy was different.

The goal was not only to generate strong rental income today, but also to secure a scarce asset type that is likely to outperform the market over time. That led us back to BTS Bearing, in the well-established Supalai City Resort Sukhumvit 107.

Why Bearing, Again?

Bearing sits at a strategic intersection of affordability, infrastructure, and long-term growth. The area is connected to the Sukhumvit line via BTS Bearing, with fast access to central Bangkok, while remaining close to major projects such as Bangkok Mall, Cloud 11, and True Digital Park.

This ecosystem continues to attract expats, professionals, and remote workers who want space, connectivity, and value beyond Sukhumvit’s core.

The Investment

The investor secured a One Bedroom Plus unit of 45 sqm at Supalai City Resort Sukhumvit 107 for 2,948,000 THB, equivalent to approximately 78,000 EUR at the exchange rate at the time of purchase.

This is a key point:

units above 35 sqm are becoming increasingly rare in Bangkok’s new developments, where developers tend to maximize density with smaller layouts. A One Bedroom Plus offers flexibility — space for a home office, guest area, or long-term living — making it structurally more resilient to changing tenant preferences.

Furnishing Strategy

The unit was furnished with a total budget of 270,000 THB, balancing durability, comfort, and appeal to mid- and long-term tenants.

The investor was assisted by Zero Two Ventures partner and designer Janjira Volpi.

This setup positions the property above standard one-bedroom units, without pushing costs into luxury territory.

Rental Outlook

The estimated starting rent for the unit is 23,000 THB per month, already aligned with current demand for larger layouts in the area.

Both rent and property value are projected with a conservative annual appreciation of 5%, driven by:

- limited supply of larger units

- sustained demand from expats and professionals

- ongoing development of the eastern Sukhumvit corridor

This creates a compounding effect over time, where income and asset value grow together.

ROI Snapshot

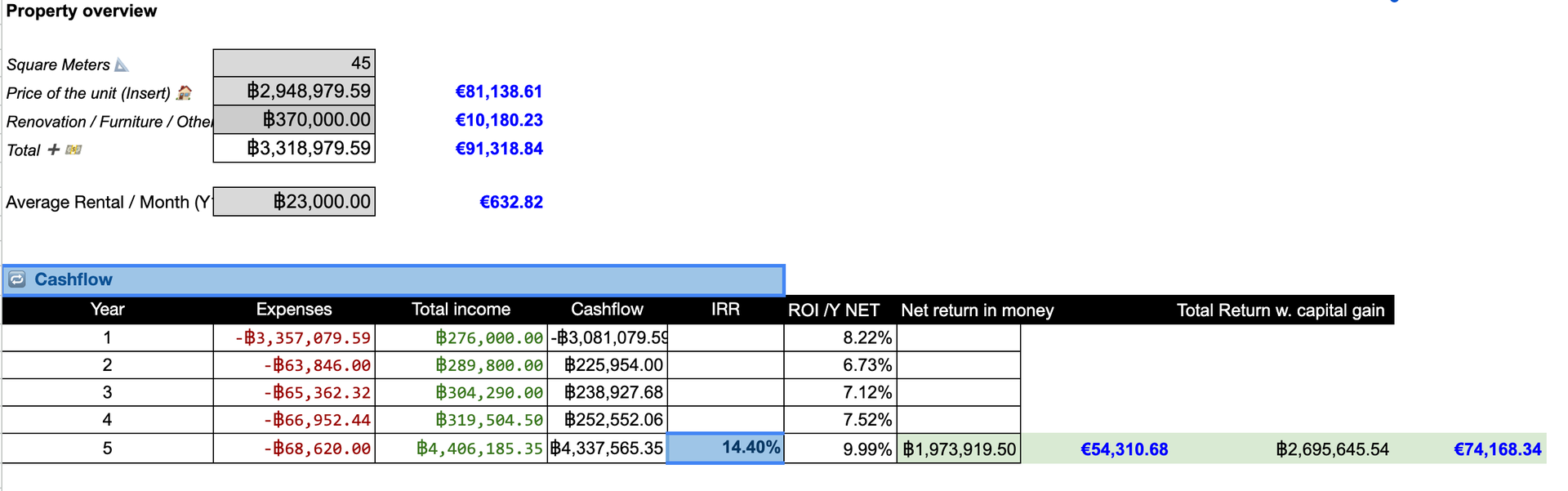

- Purchase price: 2,948,000 THB (≈ 78,000 EUR)

- Furniture: 270,000 THB

- Total investment: 3,218,000 THB

- Estimated rent: 23,000 THB/month → 276,000 THB/year

Gross Yield (year one):

276,000 ÷ 3,218,000 = ≈ 8.6%

With a 5% annual increase in rent, the yield improves progressively, while capital appreciation further enhances long-term IRR.

Why One Bedroom Plus Matters

In Bangkok, supply is increasingly concentrated in sub-35 sqm units, especially near mass transit. Larger layouts are becoming a scarcity, not a standard.

A One Bedroom Plus sits in a sweet spot: it remains accessible in price, yet offers livability that studios and compact one-bedrooms cannot match. This makes it:

- easier to rent

- more resilient in downturns

- more attractive to future buyers

Final Takeaway

This investment shows that performance in Bangkok is not only about buying cheap — it’s about buying right.

By focusing on unit size, location, and future scarcity, this One Bedroom Plus in Bearing combines solid cash flow today with structural advantages for tomorrow. A reminder that in emerging districts, the most durable returns often come from assets that others can no longer build.

The listing is currently on Airbnb with a 30-nights minimum rent.