Bangkok - Jan 2026

When two millennial investors from Italy, Beatrice & Mattia, approached me to explore real estate opportunities in Bangkok, a familiar dynamic immediately stood out: they were first-time buyers in Thailand, but already financially aware and looking for a smart, low-risk entry into an international market. Furthermore, they were looking for financing options.

After several videocalls and scenario analyses, we focused on a well-connected yet still undervalued area along the eastern corridor, selecting a project next to MRT Suan Luang Rama IX, one of Bangkok’s most livable and green districts.

Why Suan Luang Rama IX?

The condo is located next to Suan Luang Rama IX Park, Bangkok’s largest green area, and within immediate reach of Srinakarin Train Night Market and Seacon Square, two major lifestyle and retail hubs.

The MRT line connects directly to the city center, while the area is also just 10 minutes by car from On Nut and True Digital Park in Punnawithi (BTS), making it attractive for professionals, digital workers, and long-stay tenants seeking space, greenery, and connectivity without central Bangkok prices.

The Investment

The buyers secured a 28 sqm unit in a ready to live condominium, developed by one of the most recognized developers in Thailand, fully furnished, for a total price of 2.09 million THB.

Instead of paying the full amount upfront, they adopted a phased payment structure, allowed by the developer. A strategy that allowed them to enter the market while preserving liquidity:

-

70% paid immediately:

2.09M × 70% = 1,463,000 THB -

Remaining 30% spread over 3 years:

10% per year = 209,000 THB per year for the next three years

This structure significantly reduced upfront exposure while locking in today’s price in an area with strong long-term fundamentals.

Market Entry and Rental Performance

The unit has been rented on AIRBNB (The listing is here) in less than 2 hours for 5 months at 13,000 THB per month, generating immediate cash flow despite not yet being at full market potential.

At stabilized regime, the expected rent is 15,000 THB per month, aligned with comparable units in the area as demand continues to grow.

Rental Strategy

The strategy here is deliberately conservative:

- Current rent: 13,000 THB/month to ensure stable occupancy and the first Airbnb reviews

- Stabilized rent: 15,000 -18.000 THB/month as the area and MRT usage mature, with an appreciation estimated in 5% year to year.

This approach prioritizes continuity and tenant quality over short-term maximization, a common choice for investors focused on medium- to long-term returns. The strategy focuses on Digital Nomads and Remote workers who are looking for units near a MRT or BTS Station and are looking for functional facilities (coworking, gym, lounges).

ROI Snapshot

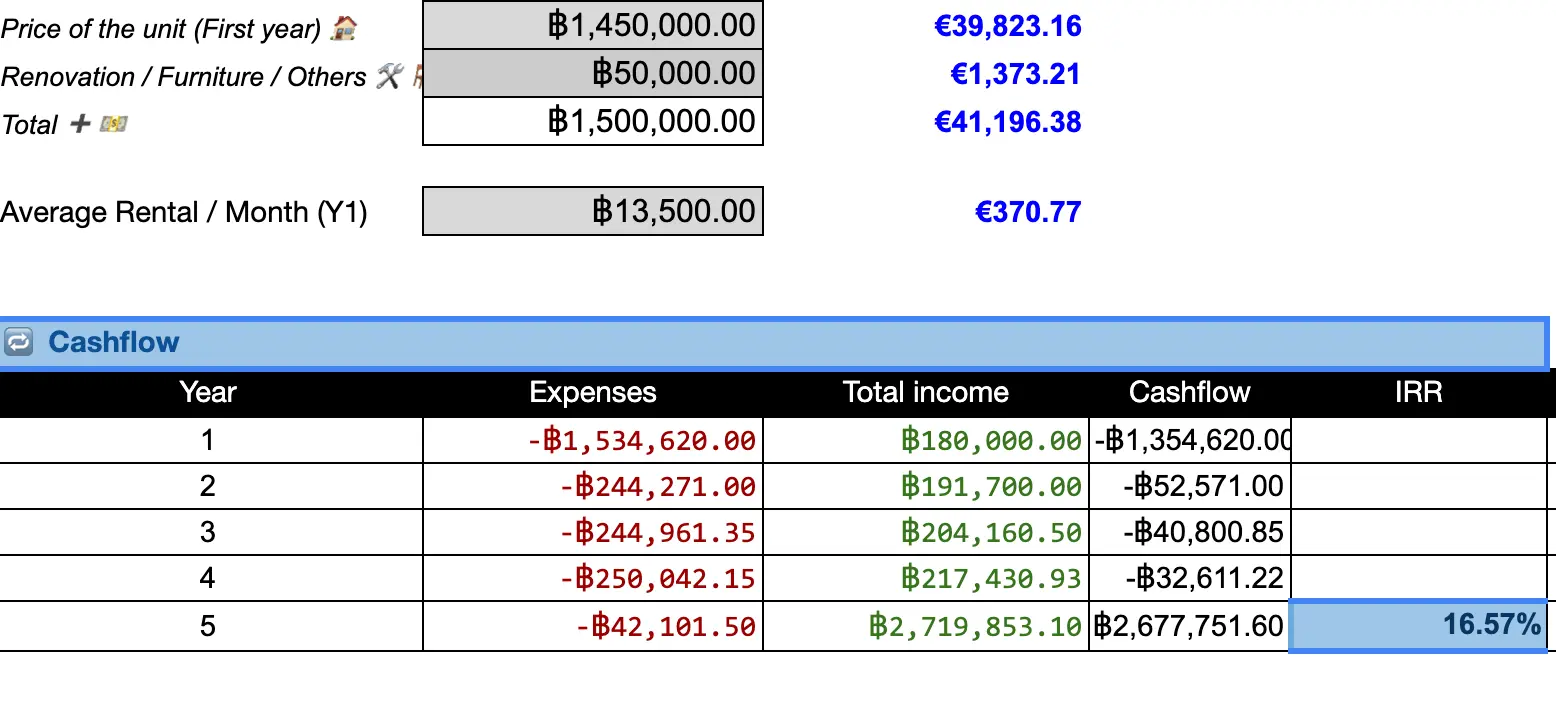

- Purchase price (furnished): 2,090,000 THB

- Current rental income: 13,000 THB/month → 156,000 THB/year

- Stabilized rental income: 15,000 THB/month → 180,000 THB/year

Gross Yield at regime:

180,000 ÷ 2,090,000 = ≈ 8.6%

IRR estimated: 16.57% with a resale in 5 years.

This yield is achieved in a green, infrastructure-backed district with strong livability appeal, while the phased payment plan further improves the effective IRR by reducing capital deployed in the early years.

Final Takeaway

This case demonstrates how smart structuring, infrastructure-driven locations, and realistic rental strategies can make Bangkok accessible even to younger investors.

By combining a phased payment plan with immediate rental income, these two millennials secured a resilient asset near one of Bangkok’s key parks and transit lines — proof that strong returns are not limited to Sukhumvit, but increasingly found where quality of life, transport, and pricing intersect.

Airbnb Listing: Link